Higher interest rates have impacted even the top slice of the luxury residential market

Luxury sales decline

Higher interest rates have impacted even the top slice of the luxury residential market.

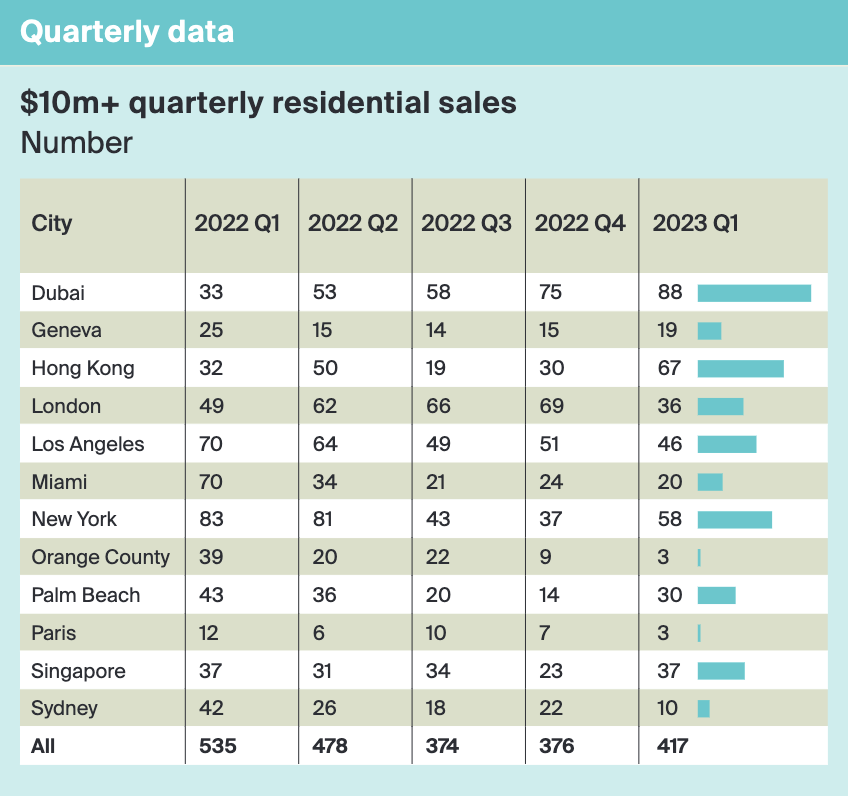

Residential sales above US$10 million in the 12 cities covered by the Knight Frank Global Super-Prime Intelligence report totaled 422 in Q2 2023, a 13% fall compared to the same period a year earlier. That said, the 1,638 global sales in the 12-month period up to June of this year represent a significant uptick on pre-pandemic sales rates. There were 1,009 sales in 2019, for example.

Despite the year-on-year decline in overall sales, four markets saw volumes rise, led by Dubai (up 79% between Q2 2022 and Q2 2023), Sydney (up 46%), Paris (up 17%), and Geneva (up 7%). The biggest declines over the year were seen in key US markets, led by Los Angeles (down 63%).

Total sales in the 12 months up to June in all markets stood at just under US$30 billion, down from the peak of US$40.7 billion seen in 2021 but well ahead of the pre-pandemic figure of US$18.6 billion in 2019.

Source: Knight Frank

Global Super-Prime Sales Slip But Stay Ahead of Pre-Pandemic Level

“Super-prime sales globally have retreated from recent highs but are still outpacing pre-pandemic levels,” said Liam Bailey, global head of research at Knight Frank. “Dubai continues to lead the pack, but London and New York are still seeing healthy volumes. The biggest constraint across a majority of markets in the near term is supply – a lack of new development starts between 2020 and 2022 means a lean 2024 for new delivery, pointing to rising competition for available stock which should act to put a floor under pricing.”

Total sales volumes for the second quarter of 2023 amounted to US$7.3 billion across the 12 markets. Dubai leads with a total volume of US$1.5 billion, with London and New York also seeing sales above US$1 billion. Total sales in the 12 months up to June in all markets stood at under US$30 billion, down from the peak of US$40.7 billion seen in 2021 but well ahead of the pre-pandemic figure of US$18.6 billion in 2019.

While U.S. housing markets have faced challenges gaining traction this year, primarily due to the impact of higher interest rates, the super-prime New York market has shown greater resilience thanks to a substantial presence of cash buyers. Additionally, in Q2, there has been an increase in demand from affluent families purchasing properties for their children to use during their schools or university years. Moreover, there is emerging evidence of demand from Asian buyers seeking alternatives to Singapore following the implementation of higher stamp duty rates in that city.

In New York, the release of several high-profile branded residence schemes has contributed to an increase in sales volumes. On the other hand, Miami is facing a different challenge, grappling with a severe shortage of super-prime properties. This scarcity is hindering sales activity despite robust demand from both domestic and international buyers.

Turning to Asia, Singapore’s super-prime market is experiencing a squeeze in sales volumes due to high purchase taxes, reaching up to 60% for foreign buyers in some cases. Although the city has been successful in attracting wealth management and family office investments, this interest has not translated into increased sales activity, as the market is adapting to rely more on domestic purchasers.

In Hong Kong, luxury demand has received a boost from mainland buyers, who had been largely absent from the market between 2020 and 2022. With greater travel expected in the remainder of the year, there is potential for increased demand. However, the main constraint lies in the limited supply of best-in-class super-prime homes.

Sydney’s super-prime market has witnessed strong sales in the last quarter, driven by a rapid surge in demand, partly from Asia but also from a significant portion of domestic buyers. Given the limited supply, buyers are actively seeking off-market opportunities to reduce competition. Looking ahead, there’s a shortage of super-prime construction in the pipeline, indicating that the supply shortage is likely to persist.

London’s market has remained relatively robust throughout 2023, although it has slowed compared to the levels seen in 2021. Overseas demand has played a role in boosting sales and recent development launches have contributed to the numbers. However, a squeeze in the future super-prime development pipeline in London suggests a potential slowdown in sales activity in 2024 and beyond unless existing property owners can be encouraged to trade up or down from their current properties.

For more info, visit: https://content.knightfrank.com/research/2666/documents/en/global-super-prime-intelligence-q1-2023-10221.pdf