The Wealth Report: Outlook 2023

Using data from Douglas Elliiman. Knight Frank’s annual Attitudes Survey of more than 500 private bankers, wealth advisors and family offices combined with in-depth conversations with industry experts, we bring you our assessment of the key themes for wealth in 2023

by Flora Harley

A TRIUMVIRATE OF SHOCKS

Four in ten ultra-high-net-worth individuals grew their wealth during 2022, despite a year of ‘Permacrisis’. Here, we delve into the results of our Attitudes Survey and assess how investors are adjusting their approach to a new era.

Every time lexicographers choose their ‘word of the year’ they provide a signal as to how the world is changing. This year, Collins English Dictionary chose ‘Permacrisis’, defined as an “extended period of instability and insecurity”.

It’s a fitting choice. The Covid-19 pandemic ended a long period of relative stability. Global economic growth has for more than a decade been underpinned by relatively benign geopolitics, globalisation and the widespread availability of cheap credit. The triumvirate of shocks that defined 2022 across geopolitics, energy and economics marked a turning point, prompting the majority of equity and bond markets to fall in tandem, culminating in the worst performance for the traditional blended portfolio since the 1930s.

For many investors it’s been a difficult year, but others have made gains despite the headwinds. Four in ten respondents to our Attitudes Survey said their clients had grown their wealth during the year, while 16% said they’d seen no change. The drivers of this performance were cited as: real estate, currency trades, market timing, and, for the first time in more than a decade, the return on cash.

Indeed, despite significant headwinds annual price growth in prime global residential markets is likely to hit 5% for 2022, according to our November Forecast. The MSCI All Property Index – an index that measures commercial property performance – was 7% higher in September compared to the end of 2021. We will reveal the full results for 2022 property performance in March.

Those that saw their wealth shrink attributed declines to equity markets, financial markets more broadly and interest rate moves. Many interviewees pointed out that the traditional diversified portfolio offered no safety amid a unique set of circumstances. The MSCI World Mid & Large Cap index was down 18%, the S&P 500 by 19%, the FTSE 250 by 17%, the Nikkei by 9% and China’s CSI 300 22%, by way of example. Longer term investors have largely been shielded due to declines by the exceptional performance of the preceding years, as pointed out by our panellist David Bailin, CIO at Citi Global Wealth Management Investments. The S&P 500, for example, was up almost 20% between 1st January 2020 and 31st December 2022.

We will delve deeper and examine the magnitude of wealth shifts through a tracker of asset performance in the March edition of The Wealth Report. We will reveal how the new investing landscape has altered the population of high-net-worth (HNW) and ultra-high-net-worth individuals (UHNWI) in May once full year data is more readily available.

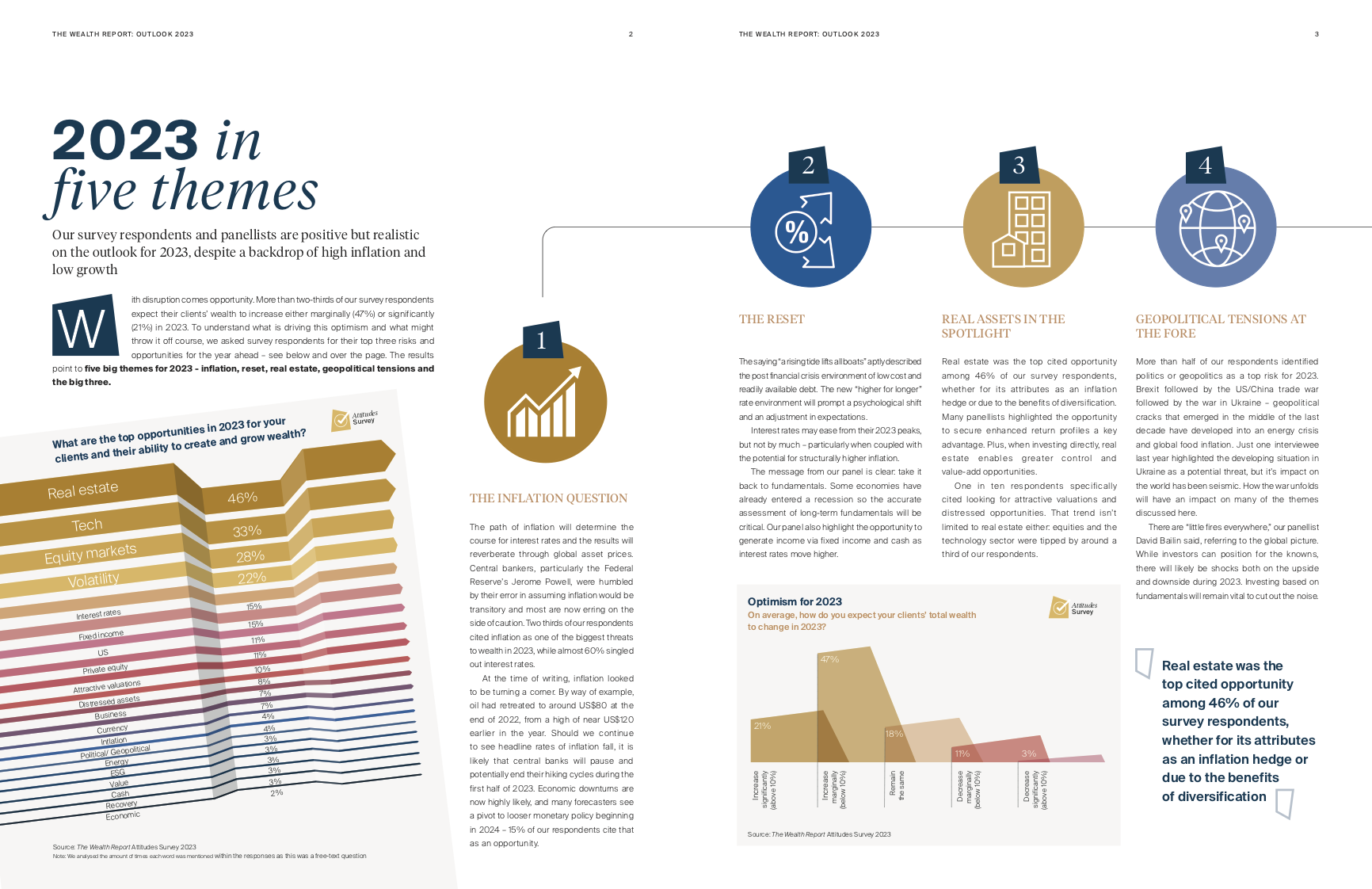

FIVE BIG THEMES FOR 2023

1. The rate of inflation will dictate when central bankers can end the current cycle of rising interest rates. The results will reverberate through borrowing costs and global asset prices.

2. There will be opportunities to reset as we enter a new investment environment, despite recessions across many major economies.

3. Real estate is the top cited opportunity among our Attitude Survey respondents seeking diversification and a hedge against inflation.

4. Geopolitical tensions were dominant in 2022 and will continue to weigh on sentiment through 2023. Many will be familiar, but there will undoubtedly be surprises.

5. The big three will have an outsized impact: the reopening of the Chinese mainland, India’s rise and the agility of the US economy.

For more information, visit: iteresources/commonresources/static%20pages/images/corporate-resources/rr/wr_outlook_2023_de_final.pdf